Do you work in sales enablement? Or maybe you’re a sales trainer or sales manager?

Whatever sales role you’re in, you’ll know the importance of a proper sales process and methodology.

Without one, your sellers will be inconsistent, they won’t be able to understand your customer’s decision process for purchasing, nor will they be able to effectively qualify leads and close deals.

As we said in our article on the Miller Heiman sales methodology:

Methodologies help salespeople have a structured approach for each time they approach a sale. That repetition of the sales process leads to consistency, and that consistency will naturally lead to better results.

Before we dive into what the MEDDIC framework, pioneered by Dick Dunkel and Jack Napoli of PTC in the 1990s, is, we need to understand why lead qualification is important in the first place.

There’s no point in understanding how MEDDIC helps us qualify leads if we don’t know why qualifying them is important and how sales methodologies tie into that!

In this article we’ll look at:

- Why lead qualification matters and how sales methodologies tie into that

- What MEDDIC actually stands for

- MEDDIC in summary

- What’s different about MEDDIC’s offshoot MEDDICC?

- And what’s different with the newest version, MEDDPICC?

Let’s jump right in. 👇

Lead qualification

In the language of B2B sales, a lead is a potential customer. Qualifying a lead means assessing whether your product or service is a good fit for the customer’s organization.

We can’t overstate the importance of this - the sales team only has so much time in a day to reach out to potential customers. The more of that time they spend with qualified customers (meaning customers who are in the right situation to buy) the better.

If a lead isn’t qualified, it’s better to try and build up your sales pipeline by looking in another direction.

Sales methodologies like SPIN, or the SPICED methodology, come into play early in the sales cycle, during the discovery call in which salesperson speaks to a potential customer in order to determine whether they are:

- A qualified lead, who is worth pursuing right now…

- Or an unqualified lead, that isn’t worth pursuing at this time.

Methodologies give salespeople a repeatable process to follow in every discovery call. That way the sales team knows exactly what information they need to find out before deciding if a lead is qualified, every time.

Even better, they create a common language between the sales team. Everyone in the sales team is using the same method to approach sales qualification, so they can lean on each other for support and receive tips and advice from one another.

Usually, methodologies will be covered during a sales rep’s onboarding process so that they have a tried-and-tested sales process to fall back on, even during their very first calls.

What is the MEDDIC sales process?

With that, we know why qualifying leads is important, and why methodologies in general can help.

Qualification helps the sales team spend time with higher-potential leads, which ultimately means that you close deals more often.

Methodologies provide framework and structure as the sales force works to qualify - essentially giving salespeople a blueprint that allows them to discern a good lead from a bad one.

But that’s in broad terms. What does MEDDIC mean? What does the MEDDIC process actually tell sellers to focus on while qualifying a lead? What are the criteria?

We’ve got the answers.

As you’ve probably already guessed, MEDDIC is an acronym. Each letter in the acronym represents a step a seller needs to take to get closer to qualifying a lead.

Another way to look at it is that each letter is a line of questioning the seller needs to go down during a discovery call in order to truly understand the lead’s potential.

Before we go through each letter and what it means, step-by-step, here’s the rundown. MEDDIC stands for:

- Metrics

- Economic buyer

- Decision criteria

- Decision process

- Identifying pain

- Champion

Now, let’s break down the acronym!

Metrics

Metrics, in this case, refers to numbers and data.

How much will your product or service cost the lead’s organization? If their budget is $100,000 a month, and you’re charging $250,000, it really doesn’t matter how much convincing you do.

It’s really important to understand the metrics involved in a potential deal, but we don’t just mean the outright, gross cost. There are other numbers that are relevant as well.

Here’s another example:

Imagine the lead’s current product costs $200,000 a month and helps them bring in $500,000 a month in revenue.

If your product costs $250,000, but will help them increase their revenue to $650,000 - you’ll find the lead will be willing to have a conversation about switching to your product. You’ve demonstrated an economic benefit to purchasing it.

On the other hand, if your product costs more and won’t bring a worthwhile return on investment, it may be worth pursuing other leads.

These examples are basic for the sake of keeping things simple, but you can see why talking about metrics while qualifying is important.

If they can’t afford it, you should probably start thinking of moving on to a lead who can.

Economic buyer

Economic buyer refers to the decision-maker in the lead’s organization. A sales rep needs to discover - and get in contact with - the person or people who are responsible for making economic decisions.

Here’s an example:

Your first contact in an organization - your lead - is a senior manager, who falls in love with your product’s features.

You think you’re onto a winner, especially with a senior-sounding job title, but then after a few discussions discover that the senior manager reports to a head of department who is actually responsible for purchasing new products.

All of a sudden, you realize that you would’ve been better served asking your lead whether they are responsible for purchasing decisions.

Of course, it’s not black and white because economic buyers and decision-makers may certainly listen to the opinions of others, but ultimately your goal in qualification has to be to identify the economic buyer and give that person your pitch where possible.

To sum up this step in one line - who makes the buying decision?

Decision criteria

Decision criteria are factors that may affect whether the lead is capable of buying your product or service right now.

It can be as simple as the organization’s usual economic buyer being on long-term leave. Something like that may cause confusion or uncertainty in a company’s decision-making process or purchasing process.

Other factors could include the organization implementing budget cuts, or whether your product or service can be implemented smoothly into the lead’s organization.

If it can’t? Well, that’s a factor that could affect the purchase!

When it comes to decision criteria, it’s very much a matter of having conversations with the lead and digging up whether any roadblocks could appear down the line.

Decision process

The second ‘D’ in the acronym, decision process, is relatively self-explanatory.

As part of your sales qualification process, you have to understand the decision-making process in the lead’s organization.

From how many steps there are, to who is involved in the approval process, to the amount of time it takes from start to finish.

Simply put: how is a final decision made in this company?

All of this is relevant information that sales reps need to discover as they work to qualify a lead.

With this information, a seller can put themselves in contact with the right people, as well as position themselves to work at the lead’s own pace.

If you know it takes three months to make a big purchasing decision, there’s no point in rushing a lead at the two week mark. It’s very difficult to rush a lead’s buying process, so pay close attention to the answers you get at this stage.

Identify pain

Identifying the potential customer’s pain isn’t as gruesome as it sounds.

It’s all about cooperating with a lead to understand their primary business objectives and what frustrations and pain points get in the way of achieving them.

If you can identify pain, you can position your product or service as a way of circumventing that pain.

Essentially, you discover what your lead’s goals are and demonstrate how your product can contribute to that overarching business goal.

This is a good place to empathize with a lead - no one likes frustrations at work. Not only is empathy a positive attribute to possess, but it can help develop trust and improve close rates as well.

More than ever, buyers are looking for empathetic, human sales reps.

Any time that you’re identifying pain, you have an amazing double opportunity. The first part is as we just said, you can really get to understand a lead, their organization, and empathize with their struggles.

The second part is that it really gives you a chance to hammer home just how great your product or service is. While the lead is talking about their common pain points, you get to present the features of your product that will solve that problem.

We come back to that idea of an economic benefit - if their pain is related to not creating enough revenue, or spending too much money, highlighting ways your product alleviates that is critical.

Champion

A champion is a person in the lead’s organization who will, of course, champion your product during the sales cycle.

These are the people with power and influence in the organization who are selling internally to other relevant stakeholders in the deal.

Normally, they have a reason for doing this - such as the adoption of your product making their job easier, or allowing them to be more successful and earn a promotion.

Essentially, your champion will sell your product on your behalf to the rest of the organization. This creates credibility because the positivity about your product is coming from inside the organization rather than outside.

Having a champion is very important to completing a deal, so make sure your sellers know to look for one.

MEDDIC in summary

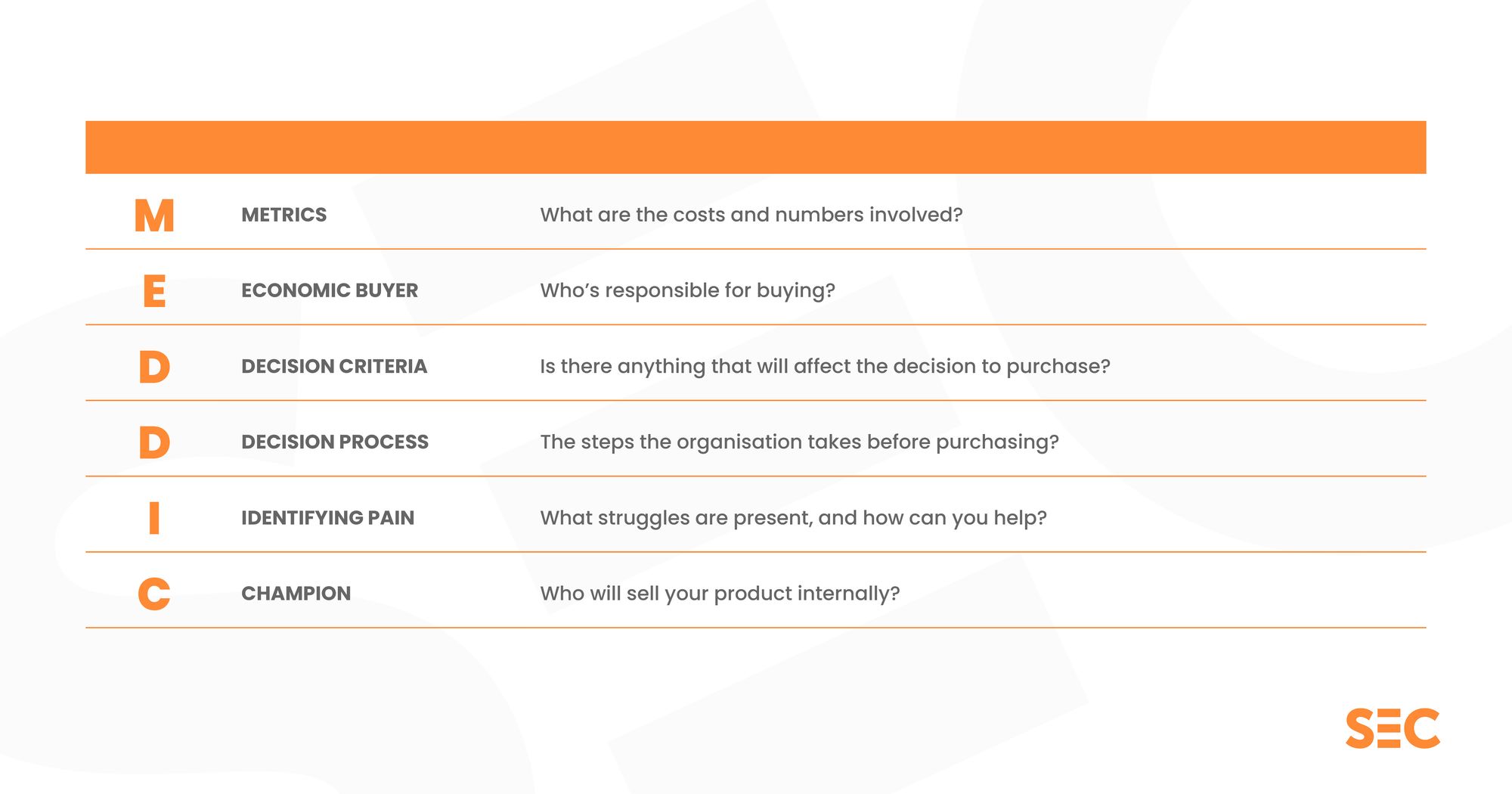

So, to summarize, MEDDIC stands for:

Metrics - what are the costs and numbers involved?

Economic buyer - who’s responsible for buying?

Decision criteria - is there anything that will affect the decision to purchase?

Decision process - the steps the organization takes before purchasing

Identifying pain - what struggles are present, and how can you help?

Champion - who will sell your product internally?

However, there is something important to note: the MEDDIC sales methodology first came about in the 1990s, but the sales landscape (SaaS especially) has changed significantly since then.

In response to these changes, offshoots of MEDDIC have sprung up, adding additional letters to the acronym.

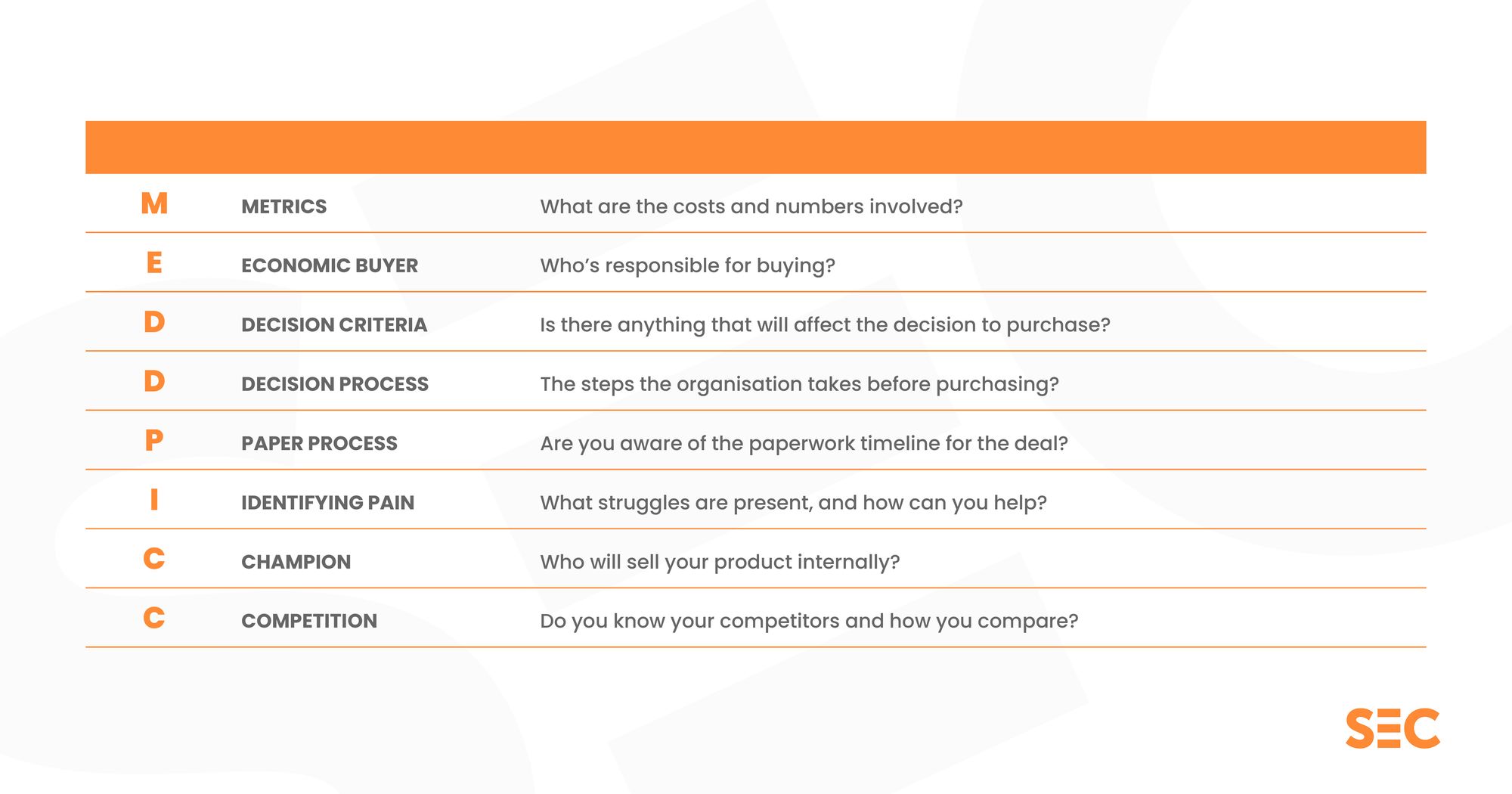

Nowadays, you’re just as likely to see MEDDICC or MEDDPICC as the original. But what’s been added to these new acronyms, and why?

What’s the difference with MEDDICC?

This variation adds an extra ‘C’ to the acronym. The rest of the letters keep their original meaning, while the new ‘C’ stands for competition.

Competition

There are more products and services in the B2B space than ever before - and the decision-makers in the lead’s organization know that.

That means modern sales teams have to be aware of their product’s position in the market, and how it compares to competitors in an honest manner.

Today, you need to highlight both your product and your competitor’s strengths and weaknesses so that the buyer can make an informed decision.

This is hugely important in creating trust because the lead then knows that you’re not hiding anything, you’re not pretending your product is perfect and all the competitors are terrible. Doing that can hurt your credibility.

You’re helping to guide them in the right direction for their organization (which hopefully is your product!).

It’s a great opportunity to work on your messaging and position your product as being able to solve the lead’s pain points in unique ways.

And what about the MEDDPICC?

The latest evolution of the acronym is MEDDPICC, adding a ‘P’ in the mix. As with before, the rest of the acronym remains unchanged.

Here, the ‘P’ stands for paper process (sometimes referred to as paperwork) and it’s another massively important addition that should not be overlooked.

Paper process

Again, as a result of an evolving B2B sales landscape, deals have become increasingly large and complicated, especially in the enterprise sales space.

What was once a simple deal may now involve a lot of paperwork, back-and-forth between legal and procurement departments, and a lot of time.

Paper process was added to the acronym to account for this.

A salesperson must be aware of factors that can delay, slow, stall, or otherwise hurt the deal-closing process in the lead’s organization.

Understanding the paperwork timeline, and all the players involved in it, is a big part of getting deals over the line.

It’s not all about the lead’s organization either - there are things you can do to ensure there’s no hiccups on your end. Make sure your team is ready to deliver contracts and other paperwork as and when it’s needed.

It’s annoying if the lead’s company is slow, but it’s even more frustrating if your own sales organization’s processes are holding up a deal!

Wrapping up

And there you have it - an in-depth guide to the MEDDIC, MEDDICC, and MEDDPICC qualification framework.

Sales leaders around the world have been using this methodology to achieve a higher closing rate in their organizations.

If you’re looking to bring in a new onboarding program, or train your sales teams in a new methodology, you should place MEDDIC and its modern offshoots under serious consideration.

If you do choose MEDDIC, you can start to create processes in your CRM to enable MEDDIC to be at its most effective, and start reaping the benefits.

Join our Slack community today and start instantly networking with 4,000+ of your sales enablement peers. Stay up-to-date on all the latest trends, share ideas, and ask questions right away.

Sales enablement insider

Thank you for subscribing

Level up your sales enablement career & network with sales enablement experts

An email has been successfully sent to confirm your subscription.

Follow us on LinkedIn

Follow us on LinkedIn