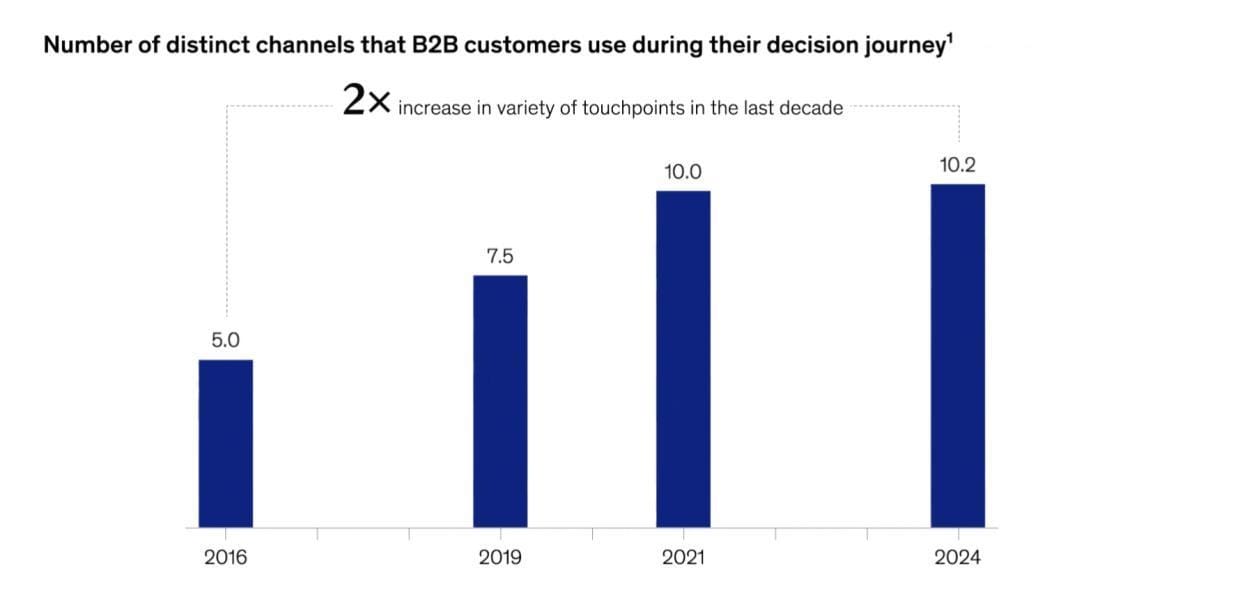

In the last decade, sales compensation has changed faster than almost any other function in SaaS. The latest Gartner sales survey on B2B buying behavior shows how B2B buyers increasingly prefer digital, self-guided sales journeys and complex internal decision processes. That shift has forced revenue teams to rethink how they structure their go-to-market motion and how they motivate sales.

Yet punitive commission plans still appear inside companies that are trying to break into the US market, establish product market fit, or build their first predictable sales engine. The structure is simple. If you miss quota, you lose part of the commission you already earned, even if you closed real revenue.

On paper, this looks strict and rational. In early stage reality, it often breaks the exact engine the company is trying to build.

How punitive sales plans let you down

Let’s imagine - a salesperson carries a quarterly quota of 30,000. They close 10,500 in monthly recurring revenue credited toward quota, landing at roughly 35 percent attainment. The guaranteed contract value from all new deals reaches about 28,000.

Based on a standard ten percent rate, the commission would normally be 2,800, but because this level of attainment falls into a mid-tier penalty bracket, the payout becomes 1,400.

At first glance, this model appears to help conserve cash. However, even in low cash flow environments, this structure becomes difficult to sustain over time. Early stage teams operate with long buying cycles, unpredictable inbound, shifting product priorities, and customers who often require significant education before committing.

When the compensation system reduces earnings so sharply during these natural fluctuations, it does not materially improve cash preservation. Instead, it creates uncertainty in the revenue function, which eventually becomes more expensive than the commission itself.

The issue is not that penalties exist. Almost every startup experiments with tightening or loosening commission mechanics, depending on runway. The challenge is that an aggressive penalty applied during the foundational phase of go-to-market makes it harder to build predictable behavior.

Reps may hesitate to pursue complex accounts, avoid multithreaded opportunities that take months to mature, or deprioritize strategic deals that could materially affect ARR but do not close within the quarter. Over time, this leads to a fractured pipeline, uneven forecasting, and slower compounding growth.

Why companies still use punitive comp plans

There are reasons these structures keep showing up, especially when leadership comes from large enterprise environments.

1 - They're meant to prevent sandbagging

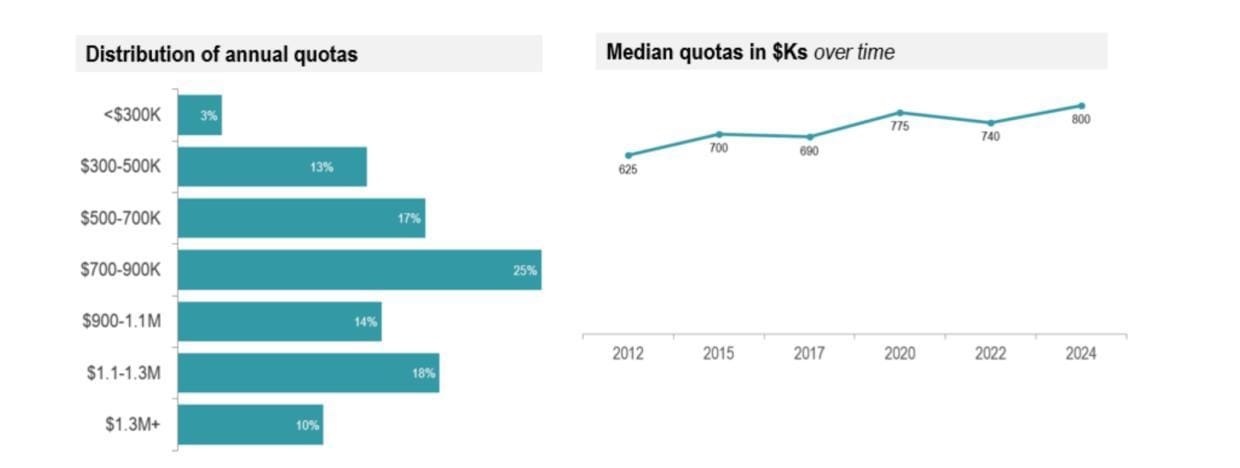

In big sales organizations, deal timing is a real problem. The Bridge Group’s 2024 SaaS AE Metrics and Compensation Benchmark summarizes data from more than 170 SaaS companies and highlights forecasting challenges that come from deals slipping or being pushed into the next quarter.

Punitive mechanics are supposed to make sandbagging less attractive.

2 - They are meant to create urgency

The idea is simple. If a rep knows they will lose money when they miss quota, they will push harder to close. In high volume, transactional sales motions, this sometimes works.

3 - They are meant to protect limited cash

Early companies with fragile cash positions sometimes use penalty mechanics to cap how much they pay out when performance is below target.

All of this assumes something important. It assumes the sales environment is stable, that there is reliable inbound, and that the product is mature enough that the main variable is the rep.

In early-stage GTM, that is almost never true.

Why punitive plans break in early GTM conditions

1. They punish reps for system level problems

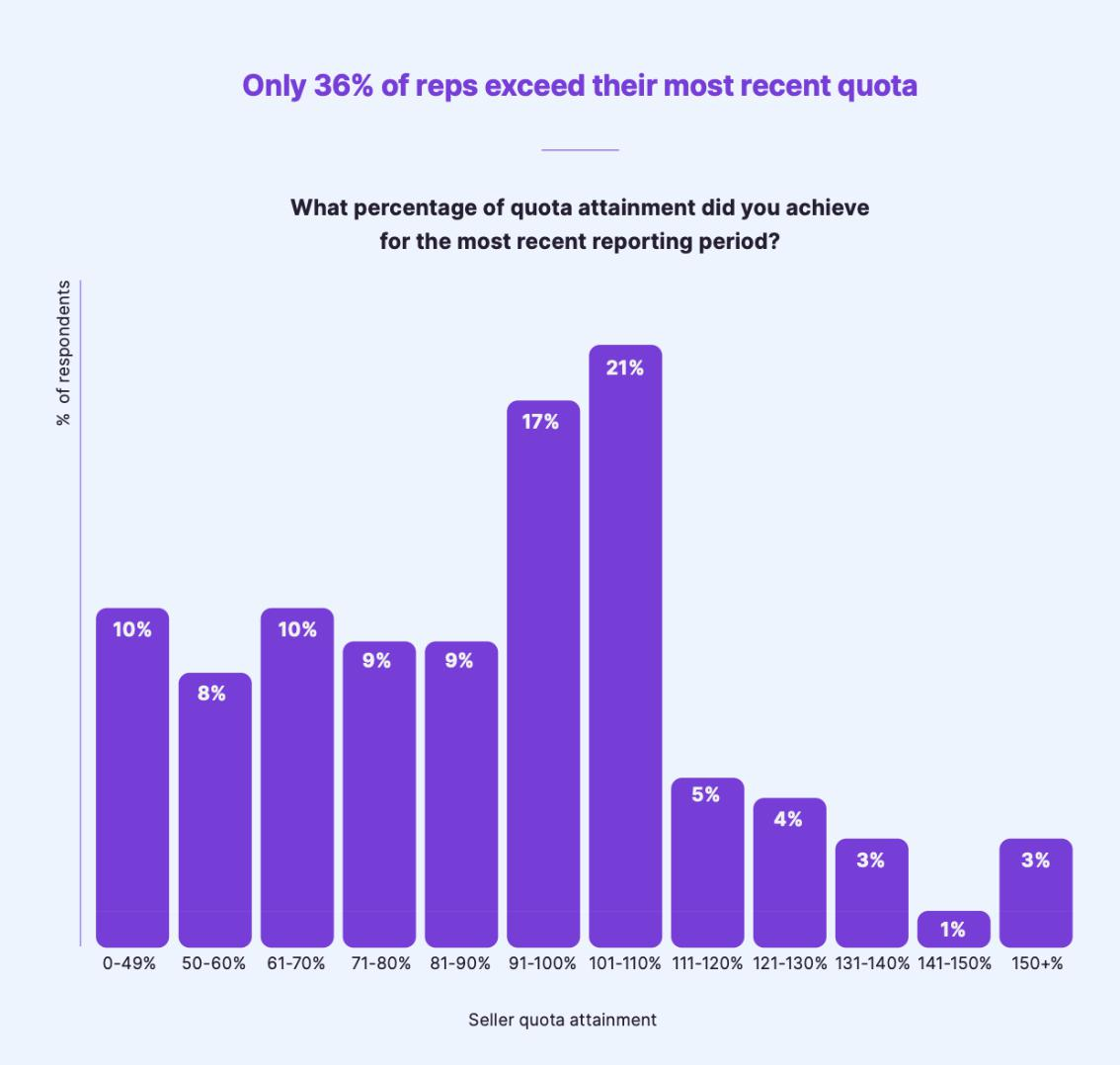

A large share of deal outcomes has nothing to do with the individual rep. Gong’s research on revenue productivity and quota attainment in The State of Sales Productivity 2024 shows that high performers succeed when they have the right tools, data, and processes, not just “more pressure.”

In early GTM environments, reps are often selling around missing features, incomplete integrations, unclear positioning, shifting pricing, and slow internal approvals. Penalizing them financially for those structural issues is misaligned with how deals are actually won and lost.

2. They reduce cognitive performance and strategic thinking

Harvard Business Review has written extensively about how stress and uncertainty affect performance. In Making Work Less Stressful and More Engaging for Your Employees, researchers note that high stress levels impair strategic thinking and creativity and make people almost three times as likely to leave their jobs.

Sales is a cognitive discipline. When a rep knows that a single quarter below quota can cut their commission in half, they shift out of strategic mode and into survival mode. Survival mode rarely produces thoughtful, multithreaded enterprise deals.

3. They distort pipeline behavior

Under penalty pressure, reps tend to

1. Prioritize small, fast moving deals over strategic accounts

2. Avoid complex customers who require education and coordination

3. Push buyers too aggressively at the end of the quarter

4. Stop experimenting with new motions or verticals

McKinsey’s work on B2B buying behavior in Five fundamental truths: How B2B winners keep growing shows that the companies that win are those that align channels, content, and human touch across long and complex journeys. Short term pressure on individual AEs rarely aligns with that.

Punitive compensation nudges reps toward decisions that are good for the current quarter and bad for customer lifetime value.

4. They damage retention and culture

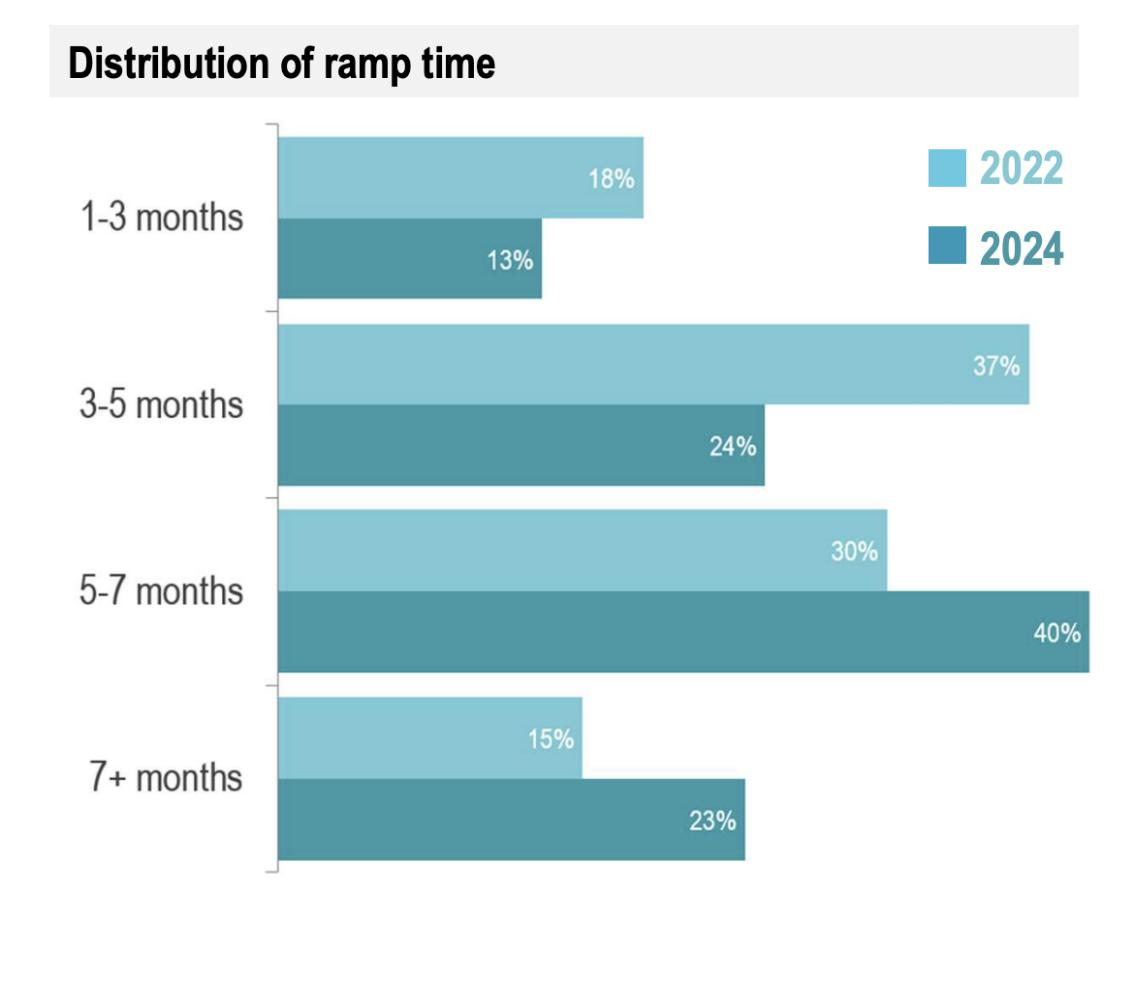

The Bridge Group’s long-running SaaS AE Metrics research shows that hiring and ramping AEs is expensive and slow. Churn in the sales team is one of the biggest hidden costs in SaaS go-to-market.

Penalty driven plans accelerate burnout and attrition. High performers with options leave first.

Those are usually the people who could have built the entire motion.

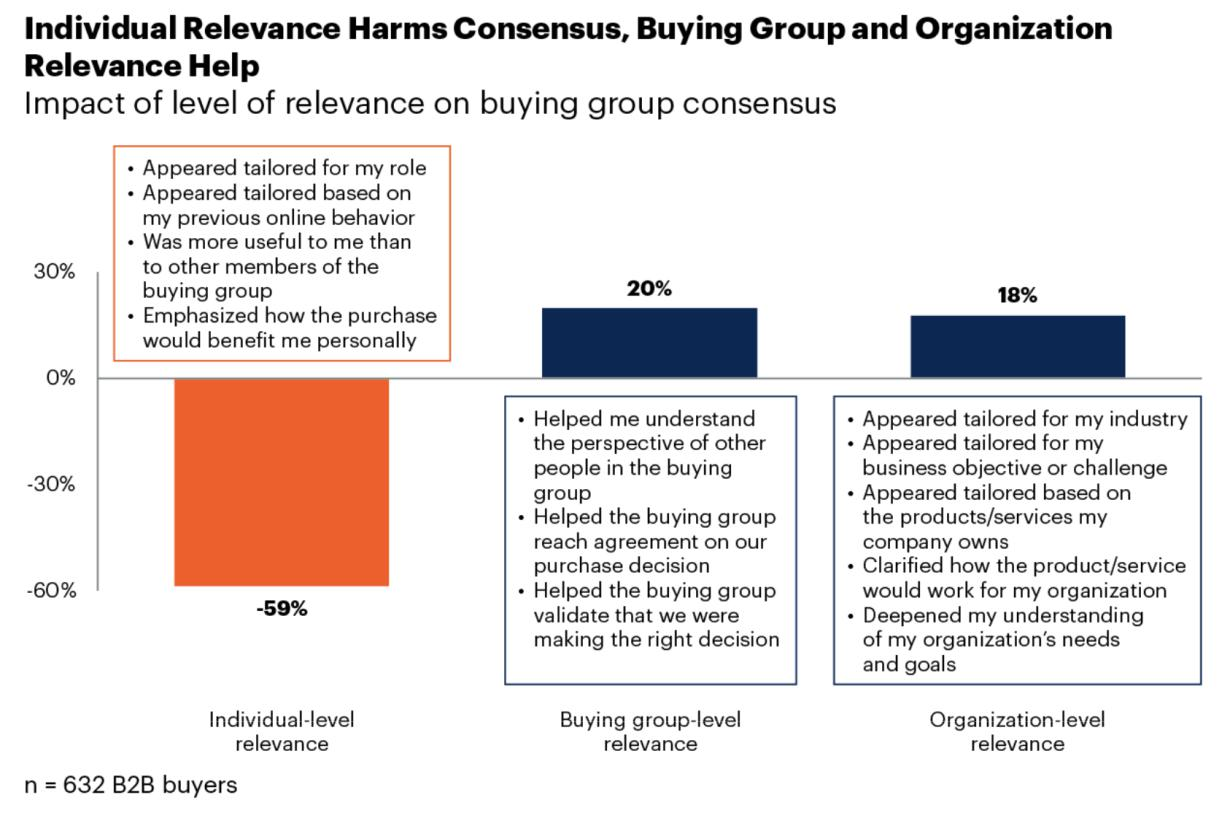

5. They ignore modern buying cycles

Recent Gartner research on B2B buying teams shows that most B2B buyer groups experience unhealthy conflict during decisions and use complex, non-linear processes.

That means timelines will stretch, stakeholders will change, and priorities will shift. Punishing individual AEs for longer cycles and increased internal conflict on the buyer side is simply out of sync with how decisions are made now.

What a healthier compensation structure looks like

Removing punitive mechanics does not mean removing accountability. The real goal is to align incentives with the actual drivers of revenue.

A healthier model for early and growth stage SaaS usually includes:

1. A consistent 10 to 12 percent commission on all new business booked

2. Clear, achievable quarterly quotas based on realistic pipeline coverage

3. Accelerator tiers that increase commission once reps pass 100 or 120 percent of quota

4. SPIFs aligned with strategic initiatives such as new product lines or target segments

5. No retroactive penalties on commission already earned

This is close to what many successful SaaS companies at Series A through Series C implement, and it matches what the Bridge Group benchmarks describe as common practice for top performing teams.

It rewards the right behaviors. It supports thoughtful multithreaded selling. It encourages reps to go after complex, high value accounts instead of racing for quick wins that look good on paper and fall apart later.

Final thoughts

Punitive commission plans are a legacy tool from a world where sales was treated as a simple control system. If numbers are low, push harder. If quotas are missed, punish the rep.

Modern SaaS is not that world. Revenue performance is shaped by product, marketing, customer success, security reviews, legal, procurement, pricing, competitive alternatives, and timing. A single person, even a very good AE, does not control all of that.

When one person is expected to build a pipeline, educate the market, manage complex stakeholders, coordinate onboarding, and still close business in a lengthening buying cycle, treating them as the main financial risk is not only unfair. It is inefficient.

The companies that win long term tend to treat sales compensation as part of their go-to-market architecture, not as a pressure tool. They design plans that reflect how buying actually works, and they pay people reliably for the real value they create.

Sales enablement insider

Thank you for subscribing

Level up your sales enablement career & network with sales enablement experts

An email has been successfully sent to confirm your subscription.

Follow us on LinkedIn

Follow us on LinkedIn

.svg)